In Florida, there are various options for homeowners to gain access to financial assistance for repairs and improvements. Grants are available from a variety of sources, including both government and nonprofit organizations.

Many of these grants provide funds specifically targeted toward home improvement projects, while others may be used to fund any type of renovation or repair. Furthermore, some grants may even offer language assistance services which can help those who do not speak English as a first language navigate the process.

The most important step is to contact the appropriate organizations and agencies in order to learn more about the specific requirements and qualifications for each grant program. Additionally, there are numerous online resources that can provide helpful information regarding home improvement grants in Florida.

With this knowledge, homeowners can take the necessary steps towards securing financial assistance for repairs and improvements today!.

In Florida, homeowners may be eligible to receive government grants for home improvement projects. Qualifying criteria for these grants can vary depending on the program and the financial situation of the homeowner.

Generally, applicants must demonstrate a need for assistance with home repairs or renovations that are necessary to maintain or improve the safety and health of their family. Additionally, applicants must meet certain income requirements to qualify for the program.

In addition to income qualifications, homeowners must also own their property outright or have an acceptable mortgage balance. Homeowners who do not meet all of these criteria may still be eligible if they can provide evidence of extenuating circumstances such as job loss, disability, death in the family, or other financial hardship situations.

Furthermore, local governments may also offer additional programs that could be available to assist with home repair costs. It is important for homeowners to research all available resources before starting a home improvement project in order to ensure they are taking advantage of any grants or assistance that may be available.

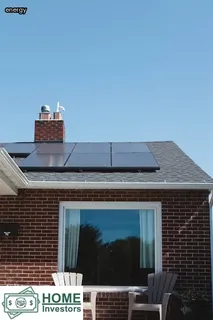

In Florida, there are a variety of home improvement and repair needs that can be covered by financial assistance. Homeowners in need can get help with installations of air conditioning units, roof replacement and repairs, structural improvements and repairs to plumbing, electrical work, and HVAC systems.

Other general home improvements like painting, siding replacement, window and door installations, drywall repair and flooring installation can also be covered. In addition to the specific types of repairs already mentioned, financial assistance is available for other energy-efficient upgrades such as insulation or energy efficient appliances.

Finally, assistance can also be provided for other related expenses such as debris removal or paying for permits or inspections. With all these options available in Florida for homeowners needing assistance with their home improvement projects, it’s easy to get the help you need today!.

The Florida Housing Finance Corporation (FHFC) is a great resource to turn to when needing assistance with home repairs. They offer several programs that can help make the cost of repairs more manageable.

The agency's Homeowner Rehabilitation Loan Program offers low-interest loans to qualified homeowners in order to finance repairs or upgrades. The program is designed to provide financial assistance to those who are unable to get traditional financing, such as a bank loan, and can also be used for energy-efficiency improvements.

Additionally, FHFC offers an Emergency Homeowners Loan Program which provides up to $50,000 in no-interest loans for homeowners facing foreclosure due to an involuntary job loss or reduction in income. These loans are available for up to 24 months and may be used for repairs and other costs related to keeping the home safe from foreclosure.

Finally, FHFC has a Foreclosure Counseling Assistance Program which provides free counseling services for those at risk of losing their homes due to financial hardship. With so many options available through the FHFC, homeowners living in Florida have access to much needed financial assistance for home repairs today!.

Habitat for Humanity is a reliable source of financial assistance for home repairs in Florida. With a mission focused on building and repairing homes to provide decent, affordable housing, Habitat for Humanity has become a trusted resource for many families seeking help with home improvement projects.

Through its volunteer-led construction teams, Habitat for Humanity works to build or repair homes throughout the state of Florida, offering financial support and expertise on how to best take care of a home. In addition to their construction services, they also offer access to additional resources such as grants and low-interest loans that can be used to fund repairs and upgrades.

To learn more about what Habitat for Humanity can do for you, visit their website or contact your local affiliate today. There are also other organizations in the state offering similar services such as Home Improvement Assistance Programs (HIAP) which provide funding for low-income homeowners looking to make improvements on their homes.

HIAP provides information about affordable financing options available in Florida and offers advice on how best to use these funds. With the right resources, any homeowner in Florida can find the help they need to keep their homes safe and secure.

In Florida, veterans can get financial assistance for home repairs and rehabilitation services through various state and federal programs. The Department of Veterans Affairs (VA) offers home repair grants to eligible veterans who need to make improvements to their primary residence in order to maintain its safety and/or alleviate health hazards.

Grants may also be awarded for the installation of ramps or other accessibility modifications that help disabled veterans better access their homes. Additionally, disabled veterans may be eligible for a one-time benefit from the VA to cover the cost of major home repairs such as roof replacement or structural repairs.

Local non-profit organizations also provide resources such as free labor, supplies, and technical advice to help veterans with home repair projects. Furthermore, state-funded programs exist that offer low-interest loans or interest-free loans to qualified applicants who need to finance larger renovation projects.

With so many options available, veterans in Florida can easily find financial assistance for necessary home repairs.

Weatherization Assistance Programs (WAPs) in Florida are designed to help low-income households make their homes more energy-efficient. These government-funded programs provide financial assistance for home repairs and improvements, such as insulation, weather stripping, window caulking, and furnace repair.

Eligible homeowners can receive grants or low-interest loans to help with the costs of making their homes more energy-efficient. The money can also be used to purchase new appliances that have higher energy ratings.

To qualify for WAPs assistance, applicants must meet a set of requirements based on income level, residence type, and other criteria. Depending on the program, assistance may be available through local agencies such as Community Action Agencies or Utility companies.

In Florida, many utility companies offer rebates and discounts on energy bills when customers install energy saving devices in their homes. Homeowners who are interested in getting financial assistance for home repairs should contact their local Community Action Agency or Utility company to find out more about Weatherization Assistance Programs and how they can get started today!.

Florida residents living on low incomes or with financial difficulties may be eligible to receive financial assistance for home repairs. The state of Florida offers several programs that provide emergency home repair services and funds to help cover the costs.

These include funding from the U. Department of Housing and Urban Development, grants from the Florida Department of Economic Opportunity, and additional resources from local governments and nonprofits.

All these programs are designed to assist those facing economic hardship in keeping their homes safe and comfortable. To qualify for these funds, applicants must meet certain requirements such as income level, family size, type of residence, location, and other factors.

Eligible households can apply for grants to cover specific repair costs such as plumbing repairs, roofing work, electrical upgrades, and more. Additionally, some organizations offer free labor or materials for qualified applicants who need extra assistance with home repairs.

If you're a Florida resident in need of financial assistance for home repairs, explore the many options available today in order to get the support you need!.

In Florida, there are several programs available to help you get financial assistance for home repair projects, particularly roof repairs. These assistance programs can provide low-interest loans, grants and tax credits to cover the costs of roof repair projects in your home.

Depending on the type of program available in your area, you may be able to get up to $25,000 in assistance from a federal program or up to $50,000 from a state program. Additionally, many local governments offer funding for roof repairs through their own programs.

Eligibility requirements vary depending on the program, but generally include having an income at or below 120% of the median income level in your area and meeting other criteria such as having a disability or being at least 65 years old. Applying for these programs may also require proof of ownership of the property and completion of other paperwork.

If you need help with roof repairs and live in Florida, look into these assistance programs today to see if you qualify!.

Florida is a state that is prone to natural disasters and emergency situations, making it essential for homeowners to be prepared. Homeowners in Florida can take advantage of the numerous disaster and emergency management programs available to them to help protect their property.

These programs provide financial assistance for repairs and other costs associated with damage caused by storms, fires, floods, and other disasters. Additionally, they provide resources such as educational materials on how to prepare for emergencies and how to minimize damage during an emergency situation.

Homeowners in Florida are encouraged to explore their options and find out what type of assistance is available in their area. With the right information, preparation, and support from these disaster & emergency management programs, homeowners can ensure their homes are safe in the event of a natural disaster or other emergency situation.

For rural residents in Florida struggling to pay for home repairs, there are a few resources they can turn to for financial assistance. The USDA's Rural Development Loan Program is available to help low-income individuals and families in rural areas with home repairs, as well as improvements such as energy efficiency upgrades.

Additionally, the Florida Housing Finance Corporation offers a Housing Repair Loan program that provides loans up to $35,000 for eligible homeowners. Other options include grants from local governments or nonprofits such as Habitat for Humanity or Rebuilding Together Jacksonville.

It's important to be aware of all the different programs that are available in order to get the most out of any financial assistance offered. Do your research and find out what you need to do in order to qualify for available grants and loans in your area – it could be the difference between being able to make much-needed repairs or not.

The good news for senior citizens and elderly people in Florida is that there are special programs available to help with home repairs. Those who meet the eligibility requirements can get assistance with roof repair, replacement of broken windows, removal of health hazards such as lead paint or asbestos, and other improvements to their homes.

This financial assistance can be used for both emergency repairs or long-term renovations that make a home safer and more comfortable. Qualified individuals will need to provide proof of age, income, and residency before they can apply for any help with home repairs.

It's important to understand what types of expenses are covered by each program so you know where to turn for help when it's needed most. With the right kind of assistance, seniors and elderly people in Florida can get the support they need to make sure their homes are safe and well maintained.

The federal government of the United States offers home improvement grant opportunities for residents of Florida. This type of financial assistance can help homeowners who need to make repairs or upgrades to their homes.

The grant is available to households with an income below a certain threshold and can be used for various types of home improvements. Eligible applicants may receive up to $7,500 in assistance for single-family residences.

Qualifying projects include roof replacements, energy efficiency updates, and structural repairs that are necessary for safety reasons. To apply for this grant, applicants must fill out an application form and provide documentation such as proof of income, property ownership records, and cost estimates from qualified contractors.

Homeowners should act quickly as these funds are limited and often run out before the end of the year. Assistance is also available at the state level through programs like the Florida Home Improvement Access Program (HIP).

HIP provides grants ranging from $2,000 to $25,000 to cover costs associated with exterior home repairs or improvements such as window replacement and air conditioning installation. For more information on how you can get financial assistance for home repairs in Florida today, visit your local County Grants Office or contact your state housing department.

In Florida, there are numerous organizations and charities that provide financial assistance for the repair and maintenance of homes. Whether you need help with roofing, plumbing, electrical work, or other home repairs, there are resources available to help you get the funds you need.

Non-profit organizations like Habitat for Humanity offer grants and loans specifically for home repairs. Low-income residents may also be eligible for housing grants from their city or county government.

Charitable foundations such as The Home Depot Foundation can also provide financial support in the form of free materials or discounts on labor costs. No matter your financial situation, there are options out there to receive aid in repairing and maintaining your home in Florida.

Local governments in Florida have many options to provide financial assistance to those needing help with home repairs and improvements. Homeowners can apply for grants and other forms of funding to help pay for home repairs, such as the State Housing Initiatives Partnership (SHIP) Program.

This program offers low-interest loans and can even provide homeowners with up to $60,000 of assistance depending on their needs. Additionally, there are several local programs that offer financial aid for needed repairs, including the Emergency Home Repair Assistance Program (EHRAP), which provides emergency funds for qualified homeowners in certain counties.

There are also numerous organizations that can provide resources such as free counseling services or home improvement grants. Finally, some counties also offer tax credits or property tax exemptions for those who make improvements to their homes.

With so many options available, Florida residents should take advantage of these programs and get the help they need to repair or upgrade their homes today!.

If you live in Florida and need assistance with covering the costs of a major home repair or upgrade, there are several private loan options available. From personal loans to lines of credit, these loans can get you the money you need to make your repairs quickly and conveniently.

When it comes to getting funds for home repairs, many people prefer personal loans because they offer fixed interest rates, fixed monthly payments and can be approved very quickly. Lines of credit are also beneficial as they provide access to revolving cash so that you can borrow what you need when you need it without having to reapply each time.

Both of these loan options give borrowers more control over their financing needs and allow them to get the funds they need quickly. If a major repair or upgrade is necessary for your Florida home, consider taking advantage of one of these private loan options today.

Finding the right contractor for home repairs in Florida can be a daunting task, particularly if you’re in need of financial assistance. Fortunately, there are contractors who specialize in providing financing solutions to help you make home repairs within the state of Florida.

These contractors have the expertise and resources necessary to help you navigate the complicated process of obtaining financing for your repair needs. Whether you’re looking for a loan or other forms of funding, these experts can guide you through the entire process from start to finish.

They understand that not everyone has access to sufficient funds for repairs and offer numerous options for homeowners in need of assistance. With their expertise, you’ll be able to find a solution that fits your budget and get the repairs done quickly so you can enjoy your living space once again.

So don’t wait any longer – contact one of these professional contractors today and get financial assistance for your home repair needs in Florida!.

For individuals making significant renovations to their primary residence in the state of Florida, there are a range of tax benefits available. One of the most useful is the ability to deduct qualifying expenses from your taxable income.

Those who are undertaking renovations can potentially reduce their taxable income by up to $25,000 per year. Additionally, homeowners can also benefit from certain sales and use taxes exemptions on materials and supplies used for renovation projects.

Furthermore, individuals may be eligible for homestead exemptions which provide tax relief for homeowners living on low or fixed incomes. Finally, it is possible to receive financial assistance from the federal government or local agencies when undertaking home repairs in Florida today.

By taking advantage of these various tax benefits and other sources of assistance, individuals can make major improvements to their homes without worrying about the financial burden that often comes with such projects.

In the state of Florida, homeowners may be entitled to financial assistance for home repairs due to structural damage caused by natural disasters or other occurrences. Insurance coverage in this situation can vary widely based on the type of policy purchased and the severity of the damage.

Typically, policies cover damages from wind, hail, lightning, fire, smoke, and explosions; however, they usually exclude damages caused by floods and earthquakes. Depending on the amount of coverage purchased and the extent of the damage, homeowners may have to pay out-of-pocket costs for repairs that are not covered by their insurance policy.

It is important to review your policy carefully before making any decisions about how to proceed with structural repairs in order to get a full understanding of what is covered and what is excluded. Additionally, those who are facing financial hardship due to structural damage may be able to take advantage of various forms of assistance through a number of private and public organizations.

By researching all available options and taking advantage of any resources you may qualify for, you can get financial assistance for home repairs in Florida today!.

The $10000 grant for Florida homeowners is a financial assistance program established by the state of Florida to help qualified individuals with home repairs. The program is designed to provide much needed relief for those struggling to keep up with the costs associated with maintaining their homes.

Eligible homeowners in Florida can apply for this grant, which will cover up to $10000 in home repair costs, such as roofing and insulation repairs, plumbing and electrical system upgrades, window replacements and more. To qualify, applicants must show proof of ownership of a primary residence in Florida and demonstrate financial need.

This may include income documentation, bank statements or other evidence that proves eligibility. The goal of this program is to make life easier for those who are struggling financially but still want to maintain their homes safely and comfortably.

With the help of this grant, many Floridians can now make necessary repairs without facing an overwhelming financial burden.

If you're a Florida homeowner in need of roof repair, you may be eligible for free or low-cost assistance. There are a number of organizations that offer programs and grants specifically designed to help residents pay for roof repairs and other home improvement projects.

To find out if you qualify for financial aid to repair your roof, it’s important to explore all available options. The State of Florida offers numerous grant programs that can help cover the cost of roof replacement or repair, as well as other home maintenance projects.

Additionally, there are several nonprofits dedicated to providing free or reduced-rate home repairs to qualified applicants. To determine if you’re eligible for free roofing assistance in Florida, contact your local housing agency or search online for state and federal grants.

You can also check with your city or county government to see if they have any programs available to help cover the costs associated with home repairs like a new roof. Finally, don't forget to look into private lenders who may provide loans at favorable rates to assist with repairing your home's roof.

With so many options available, there is no reason not to get financial help today!.

In Florida, there are several types of grants available to help homeowners fund necessary repairs and improvements. The most common programs are the Federal Emergency Management Agency (FEMA) Disaster Relief Grant Program, the Florida Department of Economic Opportunity’s Homeowner Assistance Program, and the USDA Rural Development Direct Loan Program.

To qualify for any of these home improvement grants in Florida, applicants must meet certain eligibility criteria. FEMA Disaster Relief Grants are available to individuals and households who have experienced significant damage or destruction due to a natural disaster such as a hurricane or tornado.

To be eligible for this grant, you must have experienced serious damages from a declared disaster event and be able to show that insurance coverage was inadequate to cover the cost of repairs or rebuilding your home. The State of Florida’s Homeowner Assistance Program is designed to provide financial assistance to low-income homeowners who need help with home repairs or improvements that would not otherwise be affordable.

Eligible applicants must have an income at or below 80 percent of the median income for their county; demonstrate a need for the repairs; and agree to an energy efficiency audit and energy efficient upgrades if requested. Finally, the USDA Rural Development Direct Loan Program can provide affordable loans to rural residents who need assistance with financing home repair projects such as replacing roofs, providing accessibility modifications, making energy efficiency upgrades, and more.

Eligibility requirements vary based on income level and type of project being undertaken but all applicants must own their own homes and live in designated rural areas. Whether you’re looking for emergency relief after a natural disaster or just trying to make some much needed improvements on your home, getting financial assistance for home repairs in Florida is possible if you meet eligibility requirements for one of these government grant programs.

Are you a Florida homeowner in need of financial assistance to repair or replace your roof? You're not alone. Many Floridians face the challenge of finding affordable financing for home repairs and improvements.

Fortunately, there are several programs available in Florida that can help you get the financial assistance you need to make necessary repairs and improvements to your home. The Florida Department of Economic Opportunity provides a variety of funding options for homeowners who need help with roof repairs and replacements, including grants and low-interest loans.

In addition, local municipalities, community organizations, and non-profit groups provide assistance in the form of grants and loans specifically designed for roofing projects. By researching all of your options, you can find the best program to get the financial assistance you need for your roofing project today.

A: In order to qualify for homeownership in Florida, an owner-occupied home must meet certain requirements including proof of ownership, a valid deed, and evidence that the property is owner-occupied. The property must also pass occupancy and safety inspections conducted by local authorities.

A: You can find a mortgage lender to help you fix your house in Florida by researching potential lenders online, speaking with local banks and credit unions, or asking for referrals from real estate agents.

A: Owners of principal residences in Florida may qualify for a homestead exemption, which can reduce the taxable value of their property by up to $50,000. Additionally, those who meet certain financial need requirements may be eligible for additional property tax exemptions and deferrals.

A: In order to qualify for U.S. single family housing in Florida, an owner-occupied single-family home must meet certain minimum requirements such as a valid deed, proof of ownership, adequate heating and cooling systems, acceptable plumbing and electrical systems, and proof of insurance coverage. Additionally, the property must be up to code with local building codes and regulations.

A: The United States Department of Housing and Urban Development (HUD) offers a variety of assistance programs to help low and moderate income families become homeowners or improve their current home. These programs include grants, loans, counseling services, foreclosure avoidance assistance, and more.

A: The U.S. Department of Housing and Urban Development (HUD) provides a variety of resources to assist homeowners in Florida, such as grants and loans for home repairs, energy-saving improvements, and more. To learn more about the available assistance programs, you can contact your local HUD office or visit their website at https://www.hud.gov/states/florida/homeownership/buyingprgms.

A: The State of Florida provides several programs to assist elderly and disabled individuals with home repairs. These include the Community Development Block Grant Program, Elderly Home Repair Program, Disabled Accessibility Program, Emergency Home Repair Assistance Program, and Home Improvement Loan Program. Additionally, the U.S. Department of Housing and Urban Development (HUD) provides various resources to help people with disabilities acquire and maintain housing.

A: The CDBG program provides assistance to low- and moderate-income homeowners in Florida through grants and/or loans for repairs related to health and safety issues. Eligible homeowners can receive up to $25,000 in grant assistance for home repairs. To qualify, applicants must meet income qualifications, have an owner-occupied primary residence in the state of Florida, and demonstrate a lack of other resources to finance the repairs.

A: To be eligible for a Block Grant or Section 504 loan to help you fix your home in Florida, you must own and occupy the residence as your primary residence. The property must also meet all HUD housing quality standards and pass an environmental review. Additionally, you must be able to demonstrate that you have sufficient income to repay the loan.

A: The U.S. Department of Housing and Urban Development (HUD) provides grant and loan programs to help homeowners in Florida with necessary home repairs. These programs are typically income-based, so it is important to check eligibility requirements before applying.

A: To take advantage of renewable energy generation for your house in Florida, you should investigate the various available financial incentives. These include tax credits, grants, or other forms of funding from organizations such as the Florida Department of Environmental Protection and the U.S. Department of Energy's Water Power Technologies Office. Additionally, local utility companies may offer rebates or other incentives to encourage homeowners to switch to renewable power sources.

A: It is important to make sure that your home has proper ventilation and the area around any heaters is clear of flammable materials. Installing carbon monoxide detectors and smoke alarms is also recommended for added protection. Additionally, keeping a close eye on young children to ensure they are not touching hot surfaces or standing too close to heat sources can help prevent accidents.

A: In order to secure homeowners insurance for a house in Florida, you will need an owner-occupied promissory note that meets the health and safety requirements of the state.

A: Depending on the type of work being done, you may need to pay fees related to permits, inspections, and labor. You may also need to pay for materials such as new parts or replacement filters. Additionally, you may incur electricity costs related to running the heater during repairs.

A: The state of Florida has adopted the 2017 National Electrical Code (NEC) as its minimum standard regulating electrical wiring in and around residential dwellings. In order to meet these requirements, any electrical work performed on a home must be done by a licensed electrician who is familiar with the local codes and regulations.

A: In order to receive reimbursement through LIHEAP in Florida, you must meet the eligibility requirements of your state and prove that you are a low-income homeowner. You must also provide proof of income, residence, and other documents as required by your state.

A: There are a variety of state and federal resources available to assist with home repairs in Florida, such as the State Housing Initiatives Partnership (SHIP) program, Community Development Block Grants, weatherization assistance programs, and USDA Rural Development loans. Additionally, the U.S. Department of Housing and Urban Development (HUD) provides resources for homeowners with approved projects such as home improvement loan programs.

A: The Florida Housing Finance Corporation offers a variety of assistance programs to help homeowners repair or improve their properties. These programs include loans and grants for home repairs, energy efficiency improvements, and emergency assistance for those affected by natural disasters such as hurricanes. Additionally, the FHFC partners with the U.S. Department of Housing and Urban Development (HUD), Federal Emergency Management Agency (FEMA) and U.S. Department of Agriculture (USDA) to provide additional resources to help Floridians fix their homes.

A: Grants and loan programs for home repairs in Florida can be found through the federal government, state and local governments, charitable organizations, and private lenders. Tax credits may be available through the IRS for energy efficiency improvements. There are also various rebate programs offered by utility companies in Florida to encourage energy-efficient upgrades.

A: The FHFC offers a variety of services and programs, including grants, loans, tax credits, rebates, and other assistance for homebuyers and homeowners. They also provide information about foreclosure prevention and can connect people with local resources such as housing counseling agencies and United Way. In addition, the FHFC partners with the U.S. Department of Housing and Urban Development (HUD) and the Federal Emergency Management Agency (FEMA) to provide disaster relief funds for home repairs.

A: The Florida Housing Finance Corporation offers home repair loans and grants, Habitat for Humanity provides home rehabilitation and repairs with volunteer labor, the US Department of Agriculture has a Rural Repair and Rehabilitation Loan Program to assist rural homeowners in making needed repairs, and the Federal Emergency Management Agency may provide assistance for emergency repairs after a disaster.

A: Depending on the type of repairs you need to make to your home in Florida, there are several sources of funding available. Grants may be offered by your local government or community organizations for specific projects or improvements. Loans may be available from state or federal housing agencies as well as private lenders. Tax credits and rebates may also be available from local, state or federal programs for energy-efficient improvements or other repairs.

A: Homeowners in Florida may qualify for grants, loans, tax credits and rebates from federal and state programs. Additionally, some private lenders and organizations also offer special loan programs to assist with home repairs.

A: The FHFC offers a range of assistance programs for homeowners in Florida, including grants, loans, tax credits, and rebates. These programs are designed to help cover the costs of repairs and renovations necessary to improve the safety and energy efficiency of your home. You may also be eligible for free home repairs through local non-profit organizations or a Community Action Agency.

A: Financial assistance for home repairs in Florida may include grants, loans, tax credits, and rebates from the U.S. Department of Housing and Urban Development (HUD). Additionally, owner-occupied homes may qualify for homeownership programs that offer additional benefits.

A: There are several grants, loans, tax credits, and rebates available for homeowners in Florida. The U.S. Department of Housing and Urban Development (HUD) offers the Homeowner Protection Program that provides funds for home repairs and improvements such as roofing and heating system repair. There are also state-level programs such as the Florida Housing Finance Corporation's Property Improvement Loan Program which provides low-interest loans for necessary repairs or upgrades to existing homes. In addition, there may be local government programs that offer grants or other forms of financial assistance to help with home repairs. Finally, some utility companies offer energy efficiency rebates that can help offset the cost of repairs or upgrades to improve energy efficiency in the home.

A: Grants and loans for home repairs are available for low-income households through the U.S. Department of Housing and Urban Development (HUD) in Florida. Additionally, there may be state or local programs that offer grants and/or tax credits for repairs. Rebates may also be available from utility providers for energy efficient upgrades to your home.

A: Grants, loans, tax credits and rebates may be available to help you repair your home in Florida. The U.S. Department of Housing and Urban Development (HUD) can provide additional resources and information about eligibility requirements for homeownership assistance.

A: Yes, some homeowners in Florida may qualify for a homestead exemption, which is a property tax credit that can reduce the taxable value of your home. Additionally, certain energy-efficiency improvements may be eligible for state or federal tax credits.

A: Homeowners in Florida may be eligible for financial assistance from the US Department of Housing and Urban Development, US Department of Veterans Affairs, Florida Housing Finance Corporation, or the Florida Department of Economic Opportunity. Each organization offers different types of assistance such as grants, loans, tax credits and rebates.

A: The Florida Housing Finance Corporation offers several programs to assist homeowners with home repairs and improvements, including loan and grant programs such as the Hurricane Mitigation Program, Accessory Dwelling Unit Program, and Homeownership Assistance Program. Additionally, the FHFC works with partner organizations such as Habitat for Humanity, United Way of Florida, and the Department of Housing and Urban Development to provide additional resources to homeowners.

A: Homeowners in Florida may be able to access grant programs from the state or local government as well as federal loan and grant programs. Additionally, the state of Florida provides tax credits for making energy efficient improvements to a home, and many utility companies provide rebates for making energy efficient upgrades.

A: Yes, the Community Development Block Grant (CDBG) is a federal grant provided by HUD which provides funding to state and local governments for housing and community development activities. The funds may be used to assist eligible owners of owner-occupied homes with necessary repairs.

A: The Housing Initiatives Partnership offers a variety of services and financial assistance options to help Floridians with home repairs, including grants, loans, tax credits, and rebates. They also offer counseling and education programs for homeownership.